“We run seminars and meet-ups to help cultivate the digital innovation happening in Ireland,” Oakes adds. “Having worked as a central banker and board director of Bank of America’s European payments business, I am very much aware of the impact, challenges and benefits from the cumulative impact of technology, the internet, big data, and future regulation in areas such as cyber security, banking, payments, and MiFID on business and consumers. Importantly, through our network of international angel investors, venture capitalists, private equity funds, innovation hubs and technology accelerators we can help match start-up tech firms with investors.”

"Simply selling a mortgage online or enabling a customer to see their account balance on their smartphone is not fintech. Fintech is about disrupting, through innovation, existing banking, payments, investment, and insurance services. Equally it is about identifying new services"

Looking at future trends in the sector he says that fintech is a broad church and there are many components to it. “It is more than just the marriage of finance and technology,” he says. “Simply selling a mortgage online or enabling a customer to see their account balance on their smartphone is not fintech. Fintech is about disrupting, through innovation, existing banking, payments, investment, and insurance services. Equally it is about identifying new services.”

Looking beyond the standard payments area, which tends to command most attention, he notes some other critical infrastructure changes. “In banking there is the instantaneous opening of retail and business bank accounts delivered by challenger banks, such as the UK’s Monese, Mondo, Atom, and Starling Bank. Further innovation is being driven by new banking platforms such as Cogni in Ireland and Holvi in Sweden which take advantage of recent EU open bank initiatives to bank data and customer geographic locations in order to offer each customer tailored and unique business and personal banking experiences. We are seeing the traditional bank model coming to an end as they morph into utility companies. Although the traditional banking model may come to an end, it is just the start of a new banking service paradigm.” He also points to the investments and pensions area where companies like Roboadvisers, Nutmeg in the UK, Robin Hood

in the US, and Rubicoin in Ireland are providing a range of services online and through apps. In the loans and

peer-to-peer or crowd-funded personal and business lending space fintech companies think of Funding Circle in the UK, OnDeck in the US, and Grid Finance in Ireland are bringing innovative new services.

The emerging area of insuretech is bringing about some potentially hugely disruptive concepts such as peer-to-peer car, personal or business insurance. “Similar to peer-to-peer lending, peer-to-peer insurance sees a number of policyholders pool together,” Oakes explains. “When the insurable risk happens, the policyholders support each other financially. If there is no claim, the insurance premiums are reduced. Effectively we are seeing all the benefits of the co-operative insurance, or lending, model being accelerated by the efficiencies and speed of the internet and technology. Examples of this include FriendSurance in Germany and Guevara in the UK. There are also a number of innovative insurance people in Ireland looking at entering the market.”

"Technology is critical. Without technology there is no way a central bank or a bank can be confident that they have the sufficient capital required to insulate them from the economic risks they undertake on a daily basis"

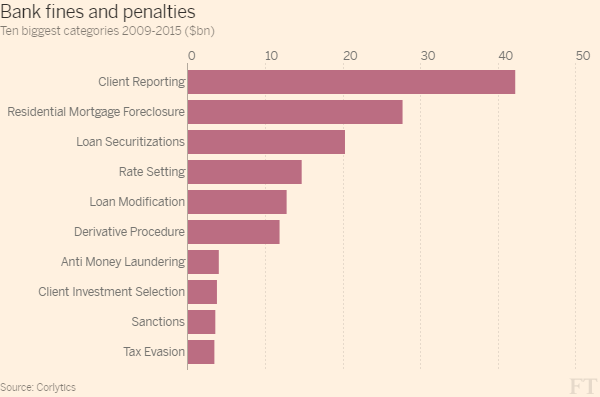

He believes regtech, or regulatory technology, will be an area of significant growth. “As more and more regulation and law comes into effect, the organisations subject to those laws such as banks, insurers, investment houses and other financial providers and those that administer the laws and regulations including central banks and regulators will need to adopt technology to analyse the huge amounts of data about the stability of systemically important institutions and important compliance obligations,” he contends. “These processes cannot be performed manually. Technology is critical. Without technology there is no way a central bank or a bank can be confident that they have the sufficient capital required to insulate them from the economic risks they undertake on a daily basis. Technology is being deployed in the fight against financial

crime and financing terrorism. Without technology it would simply be impossible to analyse trading and payments patterns to identify fraud, criminal behaviour, and stifle the flow of money which terrorists use to attack society.